2 public comments

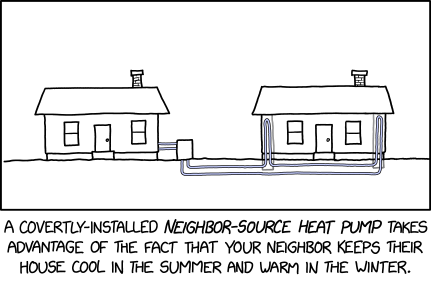

Semi-detached houses: "Look at what they need to mimic a fraction of our energy efficiency"

https://en.m.wikipedia.org/wiki/Semi-detached

https://en.m.wikipedia.org/wiki/Semi-detached

4 public comments

Incorrect analogy – More like;

1) You want a pizza made from another region.

2) However, you must sell them some your ingredients before it can be made.

3) They charge a “tariff” to protect the income of their local farmer’s for other ingredients. You’re willing to pay the “tariff” because you like your ingredients better.

4) The pizza maker sells you the final pizza with a standard sales tax but no tariff

5) You paid the higher price and they made money from the tariff.

Trump is charging tariffs to increase the costs from other regions for several reasons. A) To negotiate down tariffs from other regions. B) Lower tariffs mean you pay a lower cost for your special pizza. C) To whittle down our regions deficit. D) and/or To increase local “ingredients” growth at lower cost for you.

1) You want a pizza made from another region.

2) However, you must sell them some your ingredients before it can be made.

3) They charge a “tariff” to protect the income of their local farmer’s for other ingredients. You’re willing to pay the “tariff” because you like your ingredients better.

4) The pizza maker sells you the final pizza with a standard sales tax but no tariff

5) You paid the higher price and they made money from the tariff.

Trump is charging tariffs to increase the costs from other regions for several reasons. A) To negotiate down tariffs from other regions. B) Lower tariffs mean you pay a lower cost for your special pizza. C) To whittle down our regions deficit. D) and/or To increase local “ingredients” growth at lower cost for you.

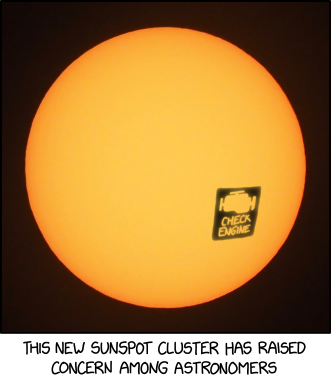

Explains with stick figures, XKCD goes to the heart of the matter of tariffs and STILL manages to make a joke!

4 public comments

Next Page of Stories

![[later] I don't get why our pizza slices have such terrible reviews; the geotextile-infused sauce gives the toppings incredible slope stability! [later] I don't get why our pizza slices have such terrible reviews; the geotextile-infused sauce gives the toppings incredible slope stability!](https://imgs.xkcd.com/comics/tariffs.png)